How to Navigate the Legal Process for Phone Rental Recovery (In 1 Read!) | 57% Success Rate in Recovering Overdue Payments

Core Summary

To help more leasing platforms and merchants understand the civil litigation process and enforcement procedures for mobile phone rental disputes, we have compiled the "Civil Litigation and Enforcement Guide" based on the latest laws and judicial interpretations.

This guide primarily covers:

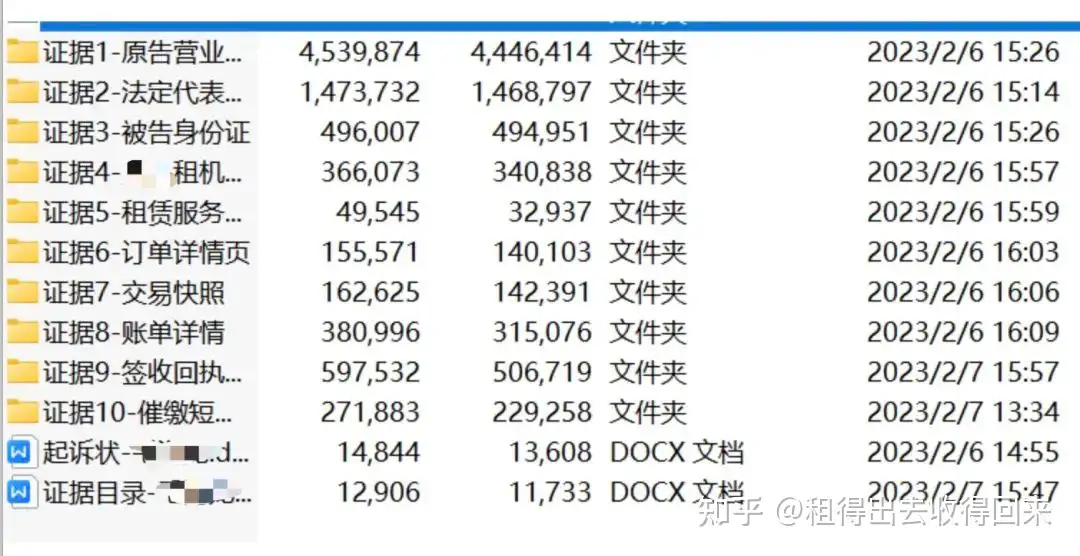

Required documentation

Litigation procedures

Enforcement measures

Litigation serves as a critical tool to protect merchants' legitimate interests. According to industry data from XINZU, legal action can recover 32.8% to 57.3% of overdue rental payments.

Step 1: Pre-Filing Preparation

Evidence Collection and Documentation

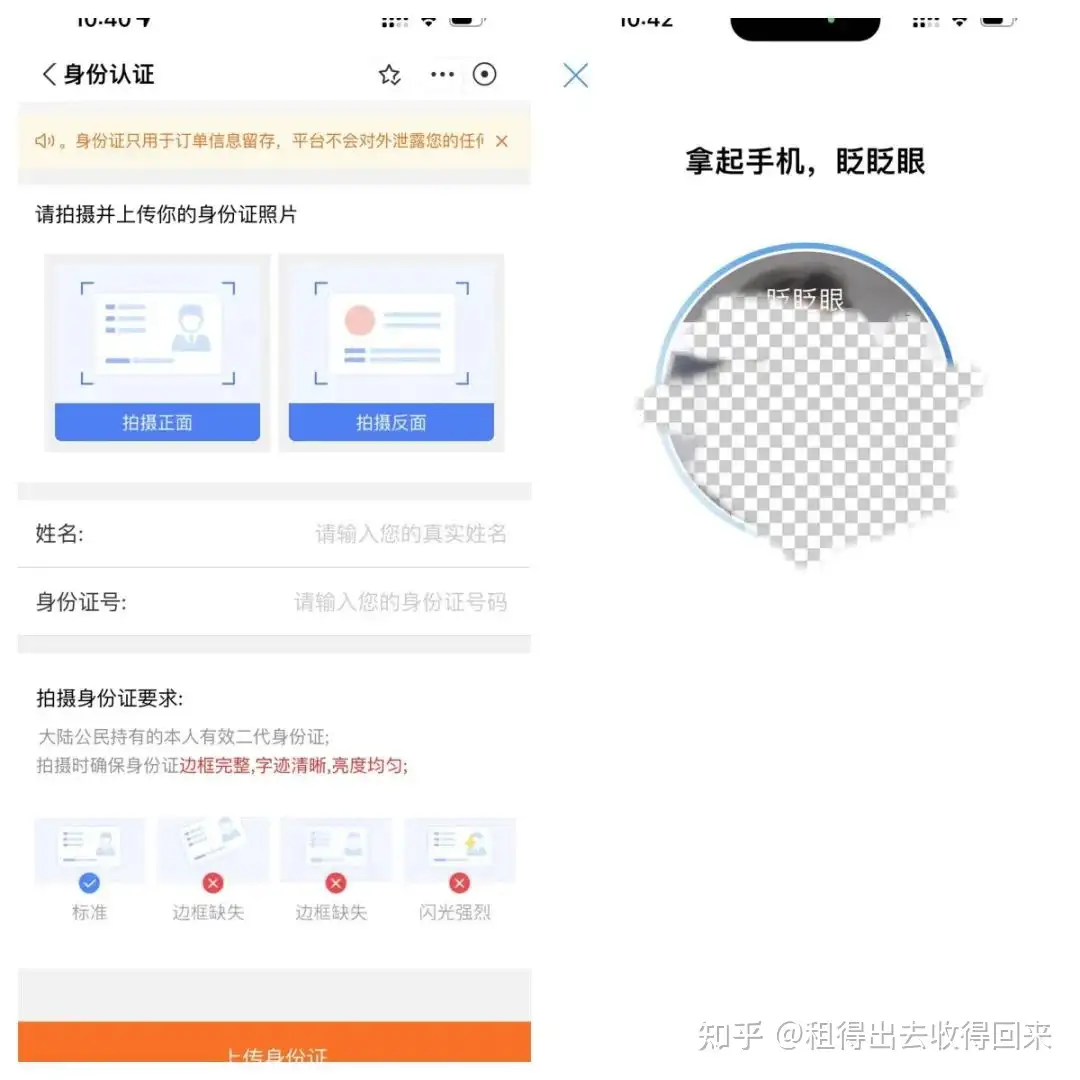

1. Identity Verification

User-uploaded ID card copies

Alipay facial recognition verification records

Proof of identity and confirmation of genuine application

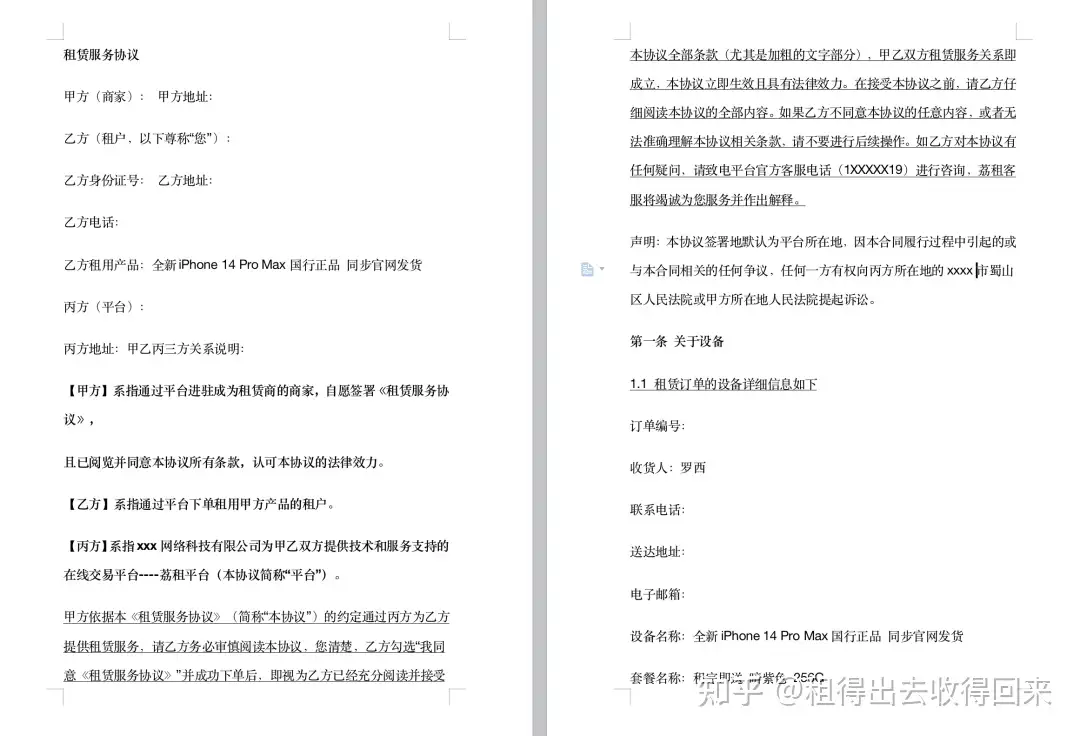

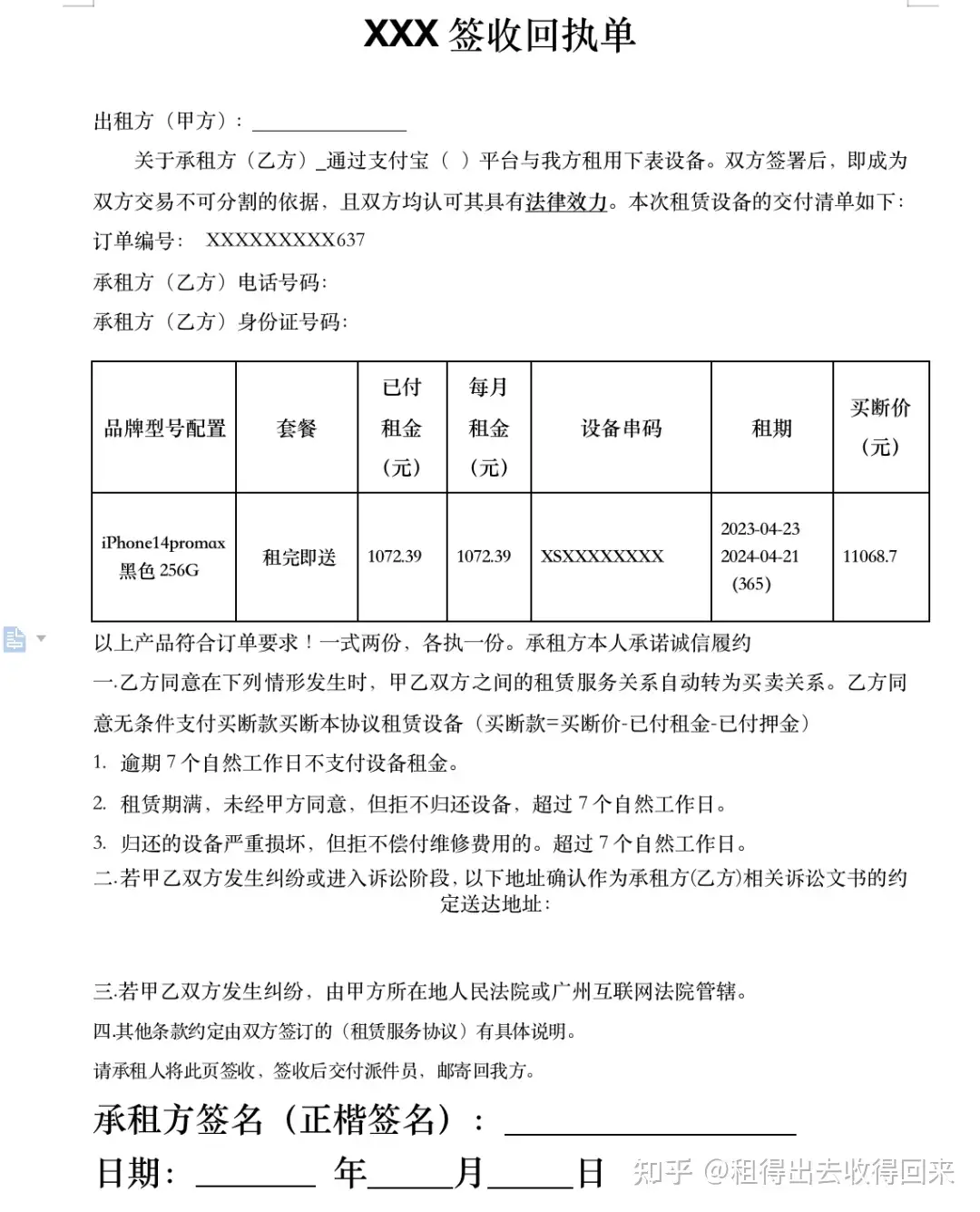

2. Evidence Establishing Legal Relationships

Lease Service Agreement

Credit Inquiry Agreement

Digital Certificate Usage Agreement

Privacy Policy and other electronic evidence

Key Focus: The Lease Service Agreement

Based on analyses of mobile phone credit lease cases nationwide, merchants should pay attention to the following:

Contract Legality: Ensure compliance with relevant laws and regulations

Rent Payment & Overdue Handling: Clearly define payment deadlines, consequences of default, and conditions for converting lease-to-own

Advance Payments & Deposits: Specify refund conditions for deposits and prepaid rents

Written Notices: Maintain evidence of notifications (SMS, email, delivery receipts)

3. Supporting Evidence

Delivery receipts

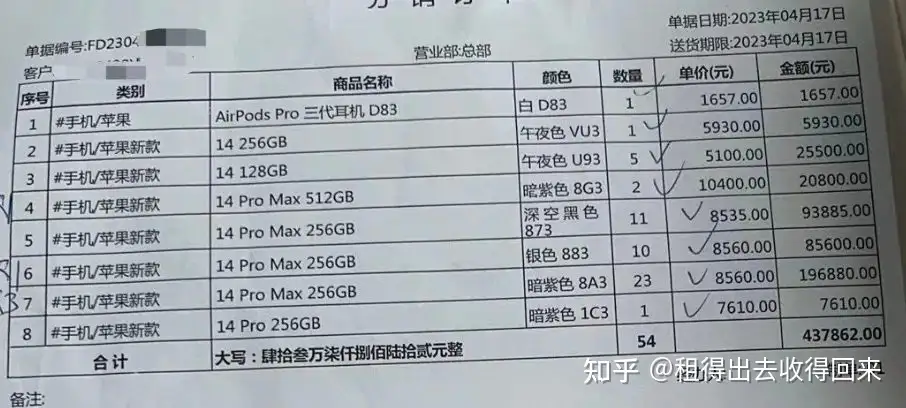

Device procurement invoices

WeChat chat records

Signed acknowledgment receipts

Electronic or paper-based signature confirmations

Step 2: Drafting the Complaint

(Can be handled by legal counsel thereafter)

Submit the complaint to the court with copies for all defendants (Number of Defendants + 1)

Contents of the complaint:

Plaintiff's details

Defendant's information

Claims and objectives

Facts and reasoning

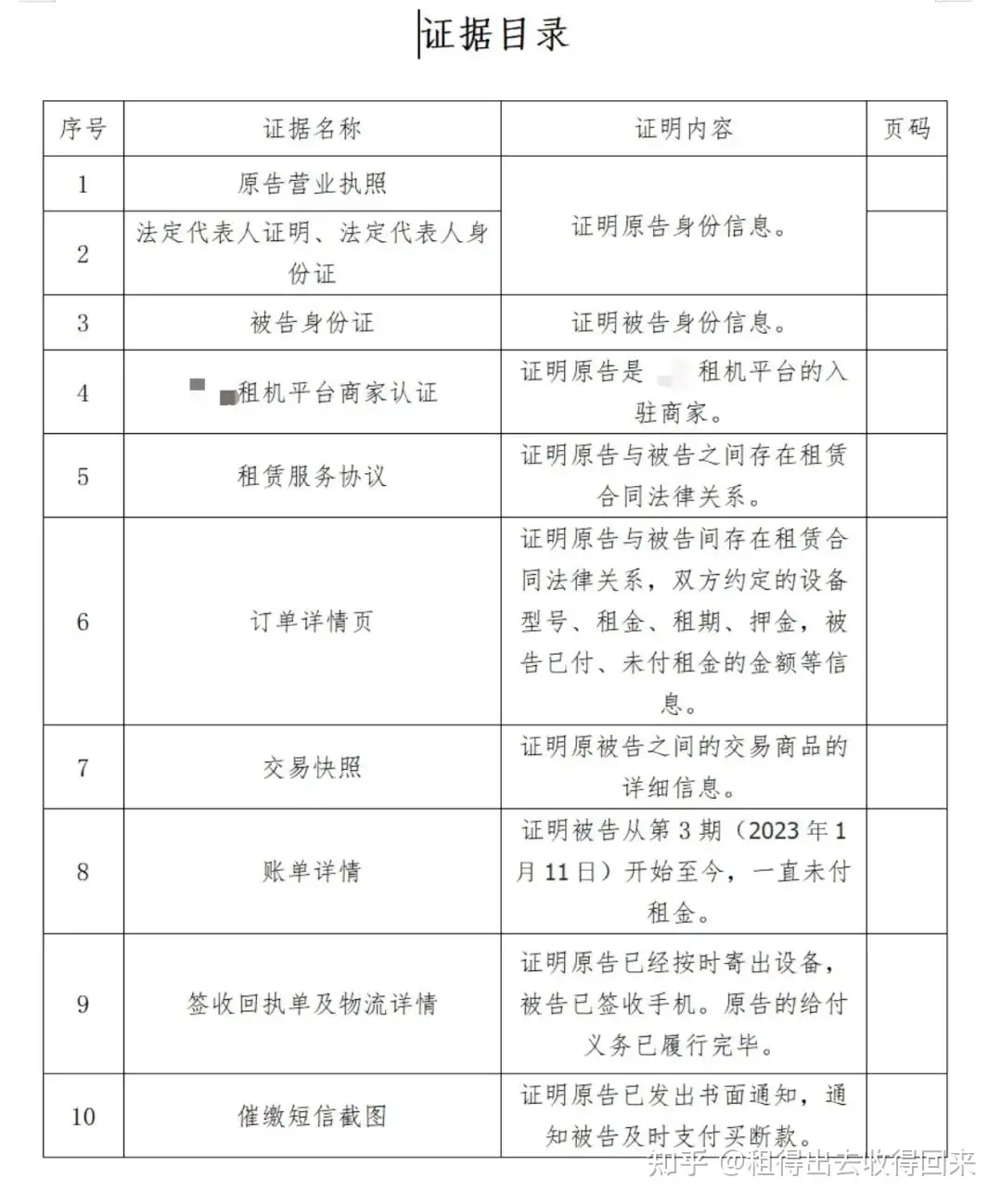

Evidence list

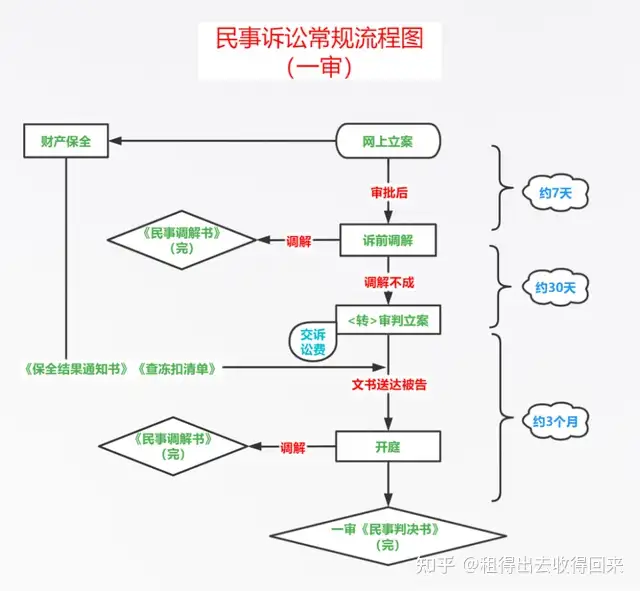

Step 3: Filing with the Competent Court

Jurisdiction typically lies where the defendant is located

Courts must accept cases that meet legal requirements within 7 days

Pay litigation fees within 7 days of acceptance

Submit property preservation applications if needed

Step 4: Service of Process

Courts typically attempt mediation first (30-day period)

If mediation fails, formal service occurs within 15 days to 2 months

Multiple delivery methods attempted before公告送达 (public notice service)

Step 5: Court Hearing Notification

Plaintiffs must attend or risk case dismissal

Defendants risk default judgment if absent

Court notices issued 3 days before hearing

Step 6: Court Proceedings

Identity Verification

Court Investigation

Plaintiff states claims and facts

Defendant responds

Evidence Examination

Both parties present and challenge evidence

Court Debate

Parties present arguments

Court Deliberation

Parties sign hearing records

Step 7: Judgment Issuance

Public announcement of verdict

15-day appeal period for judgments

10-day appeal period for rulings

Step 8: Enforcement

Application

Submit enforcement application and judgment documents

Execution

Follow up with enforcement judge within 15 days

Measures

Property seizure

Account freezing

Credit blacklisting

Restrictions

Ban on high-consumption activities

Travel restrictions

Luxury purchase prohibitions

Relevant Civil Code Provisions

Article 509: Good faith performance of contract obligations

Article 577: Liability for breach of contract

Article 585: Stipulated违约金 (breach penalties)

Articles 626/628: Payment amount, method, and timing requirements

Conclusion

When conducting mobile phone credit leasing business, merchants should focus on contract legality, clear rights and responsibilities, and strengthened credit risk control to ensure smooth operations and reduce dispute risks.

Source: Compiled based on latest judicial practices and industry data analysis.